Expo

view channel

view channel

view channel

view channel

view channel

Medical Imaging

AICritical CareSurgical TechniquesPatient CareHealth ITPoint of Care

Events

- Wireless Pacifier Monitors Vitals of NICU Babies Without Need for Painful Blood Draws

- Breakthrough Sensor Technology Tracks Stroke After Effects

- New Study Demonstrates AI-Assisted Detection of Reduced Ejection Fraction

- Novel 3D Adipose Tissue Bioprinting Method to Find Applications in Regenerative Medicine

- Miniaturized Pacemaker for Newborns Found Safe and Effective for Up to Two Years

- Online Tool Guides Surgical Decisions for Gallbladder Cancer

- Bioengineered Arteries Show Promise for Cardiovascular Surgery

- Innovative Technology Enables Rapid Life-Saving Surgical Leak Detection

- First-Of-Its-Kind Bioresorbable Implant to Help Children with Rare Respiratory Disease

- Screw-Shaped Magnetic Microrobots to Transform Treatment for Patients with Inoperable Blood Clots

- First-Of-Its-Kind Portable Germicidal Light Technology Disinfects High-Touch Clinical Surfaces in Seconds

- Surgical Capacity Optimization Solution Helps Hospitals Boost OR Utilization

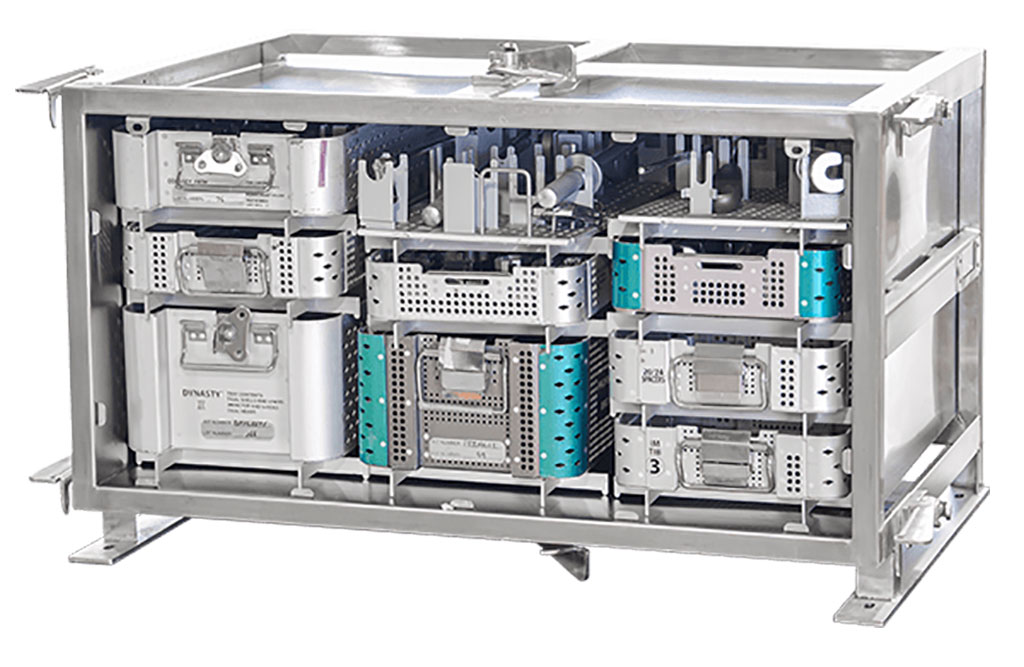

- Game-Changing Innovation in Surgical Instrument Sterilization Significantly Improves OR Throughput

- Next Gen ICU Bed to Help Address Complex Critical Care Needs

- Groundbreaking AI-Powered UV-C Disinfection Technology Redefines Infection Control Landscape

- Boston Scientific Acquires Medical Device Company SoniVie

- 2026 World Hospital Congress to be Held in Seoul

- Teleflex to Acquire BIOTRONIK’s Vascular Intervention Business

- Philips and Mass General Brigham Collaborate on Improving Patient Care with Live AI-Powered Insights

- Arab Health 2025 Celebrates Landmark 50th Edition

- Smartwatches Could Detect Congestive Heart Failure

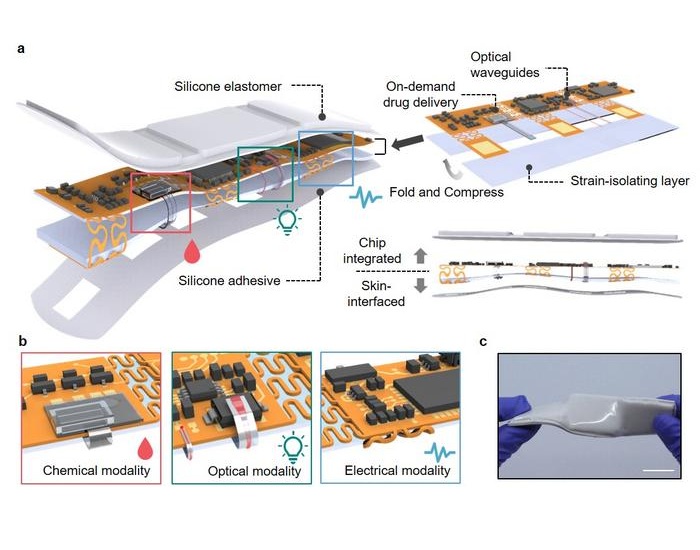

- Versatile Smart Patch Combines Health Monitoring and Drug Delivery

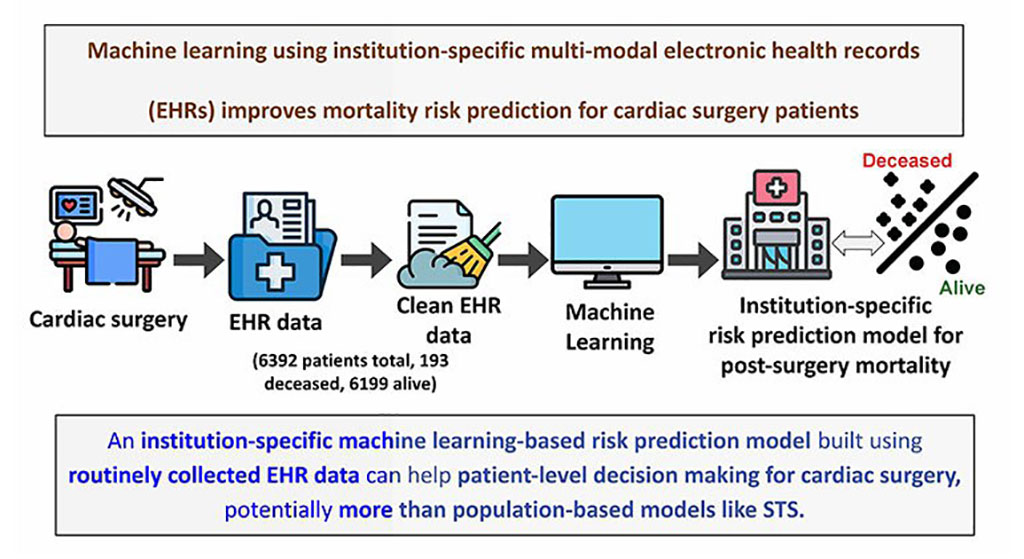

- Machine Learning Model Improves Mortality Risk Prediction for Cardiac Surgery Patients

- Strategic Collaboration to Develop and Integrate Generative AI into Healthcare

- AI-Enabled Operating Rooms Solution Helps Hospitals Maximize Utilization and Unlock Capacity

Expo

view channel

view channel

view channel

view channel

view channel

Medical Imaging

AICritical CareSurgical TechniquesPatient CareHealth ITPoint of Care

Events

Advertise with Us

view channel

view channel

view channel

view channel

view channel

Medical Imaging

AICritical CareSurgical TechniquesPatient CareHealth ITPoint of Care

Events

Advertise with Us

- Wireless Pacifier Monitors Vitals of NICU Babies Without Need for Painful Blood Draws

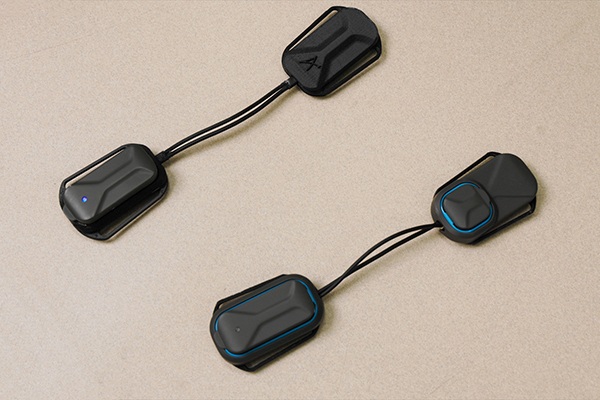

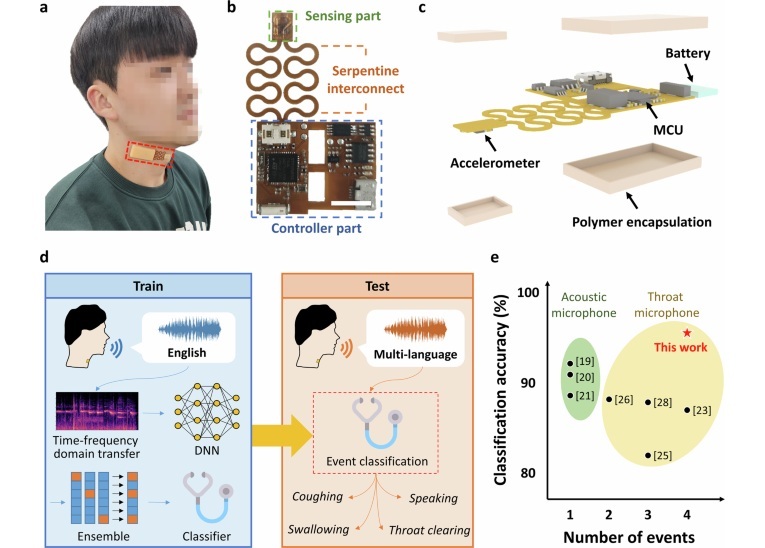

- Breakthrough Sensor Technology Tracks Stroke After Effects

- New Study Demonstrates AI-Assisted Detection of Reduced Ejection Fraction

- Novel 3D Adipose Tissue Bioprinting Method to Find Applications in Regenerative Medicine

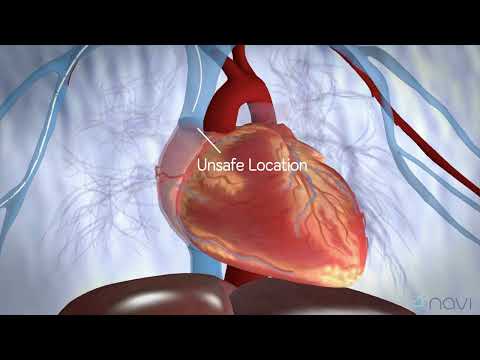

- Miniaturized Pacemaker for Newborns Found Safe and Effective for Up to Two Years

- Online Tool Guides Surgical Decisions for Gallbladder Cancer

- Bioengineered Arteries Show Promise for Cardiovascular Surgery

- Innovative Technology Enables Rapid Life-Saving Surgical Leak Detection

- First-Of-Its-Kind Bioresorbable Implant to Help Children with Rare Respiratory Disease

- Screw-Shaped Magnetic Microrobots to Transform Treatment for Patients with Inoperable Blood Clots

- First-Of-Its-Kind Portable Germicidal Light Technology Disinfects High-Touch Clinical Surfaces in Seconds

- Surgical Capacity Optimization Solution Helps Hospitals Boost OR Utilization

- Game-Changing Innovation in Surgical Instrument Sterilization Significantly Improves OR Throughput

- Next Gen ICU Bed to Help Address Complex Critical Care Needs

- Groundbreaking AI-Powered UV-C Disinfection Technology Redefines Infection Control Landscape

- Boston Scientific Acquires Medical Device Company SoniVie

- 2026 World Hospital Congress to be Held in Seoul

- Teleflex to Acquire BIOTRONIK’s Vascular Intervention Business

- Philips and Mass General Brigham Collaborate on Improving Patient Care with Live AI-Powered Insights

- Arab Health 2025 Celebrates Landmark 50th Edition

- Smartwatches Could Detect Congestive Heart Failure

- Versatile Smart Patch Combines Health Monitoring and Drug Delivery

- Machine Learning Model Improves Mortality Risk Prediction for Cardiac Surgery Patients

- Strategic Collaboration to Develop and Integrate Generative AI into Healthcare

- AI-Enabled Operating Rooms Solution Helps Hospitals Maximize Utilization and Unlock Capacity