Expo

view channel

view channel

view channel

view channel

Medical Imaging

AICritical CareSurgical TechniquesPatient CareHealth ITPoint of Care

Events

Webinars

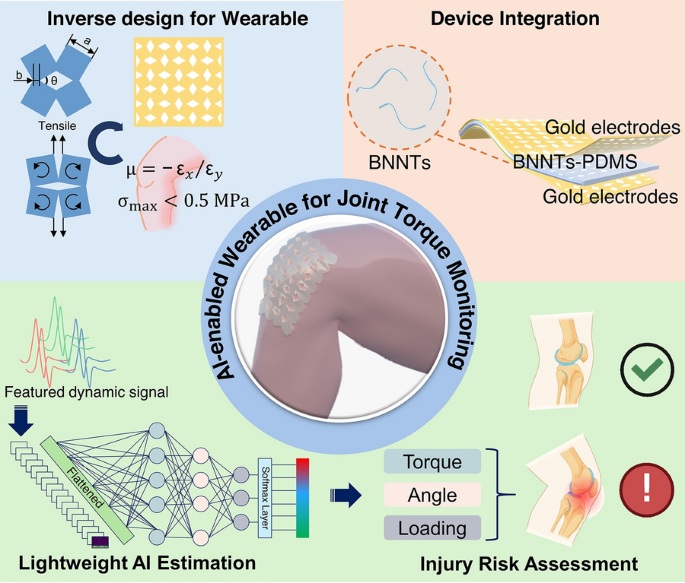

- AI-Enabled Piezoelectric Wearable to Revolutionize Joint Torque Monitoring

- New Tool Predicts Cardiovascular Disease Risk More Accurately

- First Of Its Kind Adhesive Offers More Comfortable Alternative for Wearable Medical Devices

- Discovery of Heart’s Hidden Geometry to Revolutionize ECG Interpretation

- New Approach Improves Diagnostic Accuracy for Esophageal Motility Disorders

- New Method Could Replace Laparoscopic Surgery for Groin Hernia in Women

- Tumor-Targeting Fluorescent Bacteria Illuminate Cancer for Precision Surgery

- AI Tool Detects Surgical Site Infections from Patient-Submitted Photos

- Pioneering Technique to Increase Infant Heart Transplant by 20%

- 3D Printed Implant to Help Repair Spinal Cord Injuries

- VR Training Tool Combats Contamination of Portable Medical Equipment

- Portable Biosensor Platform to Reduce Hospital-Acquired Infections

- First-Of-Its-Kind Portable Germicidal Light Technology Disinfects High-Touch Clinical Surfaces in Seconds

- Surgical Capacity Optimization Solution Helps Hospitals Boost OR Utilization

- Game-Changing Innovation in Surgical Instrument Sterilization Significantly Improves OR Throughput

- Medtronic Partners with Corsano to Expand Acute Care & Monitoring Portfolio in Europe

- Expanded Collaboration to Transform OR Technology Through AI and Automation

- Becton Dickinson to Spin Out Biosciences and Diagnostic Solutions Business

- Boston Scientific Acquires Medical Device Company SoniVie

- 2026 World Hospital Congress to be Held in Seoul

Expo

Expo

- AI-Enabled Piezoelectric Wearable to Revolutionize Joint Torque Monitoring

- New Tool Predicts Cardiovascular Disease Risk More Accurately

- First Of Its Kind Adhesive Offers More Comfortable Alternative for Wearable Medical Devices

- Discovery of Heart’s Hidden Geometry to Revolutionize ECG Interpretation

- New Approach Improves Diagnostic Accuracy for Esophageal Motility Disorders

- New Method Could Replace Laparoscopic Surgery for Groin Hernia in Women

- Tumor-Targeting Fluorescent Bacteria Illuminate Cancer for Precision Surgery

- AI Tool Detects Surgical Site Infections from Patient-Submitted Photos

- Pioneering Technique to Increase Infant Heart Transplant by 20%

- 3D Printed Implant to Help Repair Spinal Cord Injuries

- VR Training Tool Combats Contamination of Portable Medical Equipment

- Portable Biosensor Platform to Reduce Hospital-Acquired Infections

- First-Of-Its-Kind Portable Germicidal Light Technology Disinfects High-Touch Clinical Surfaces in Seconds

- Surgical Capacity Optimization Solution Helps Hospitals Boost OR Utilization

- Game-Changing Innovation in Surgical Instrument Sterilization Significantly Improves OR Throughput

- Medtronic Partners with Corsano to Expand Acute Care & Monitoring Portfolio in Europe

- Expanded Collaboration to Transform OR Technology Through AI and Automation

- Becton Dickinson to Spin Out Biosciences and Diagnostic Solutions Business

- Boston Scientific Acquires Medical Device Company SoniVie

- 2026 World Hospital Congress to be Held in Seoul